Misrepresentation and insurance

When taking out an insurance policy, it might seem tempting to minimise the risk insured against with a view to reducing the premium. However, a recent High Court case concerning a catastrophic property fire showed why absolute frankness is required.

The case of Dalecroft Properties Limited v Underwriters [2017], concerned a five-storey mixed commercial and residential property that was so severely damaged by a fire that it had to be demolished.

Its owners claimed a seven-figure sum from their insurers, but the latter refused to pay on the basis that various features of the property had been misrepresented to them.

When applying for the insurance, the owners had described the property as in good repair. However, the Court noted evidence that, among other things, many of its windows were broken or falling out and that its roof leaked.

The owners’ assertions that the property did not have a flat roof and had not been subject to malicious acts of vandalism were also substantially incorrect.

In refusing to order the insurers to indemnify the owners for their loss, the Court noted that the latter had made no real effort to fairly represent the risk. Had they done so, the insurers would probably have declined cover.

In the circumstances, the insurers were entitled to avoid the policy and tender the return of the premium.

[edit] Related articles on Designing Buildings Wiki

- Caveat emptor in property sales.

- Directors and officers insurance.

- Employer's liability insurance.

- Excepted risk.

- Failure to mention asbestos.

- Failure to notify tenant.

- Insurance.

- Legal indemnity insurance.

- Material non-disclosure.

- Non-negligent liability insurance.

- Property disrepair and landlord liabilities.

- Specified perils.

Featured articles and news

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description fron the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

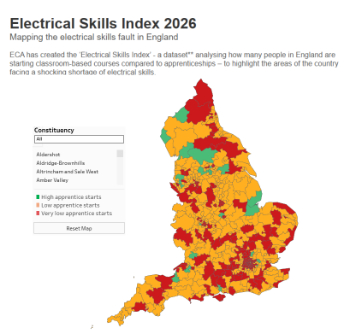

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

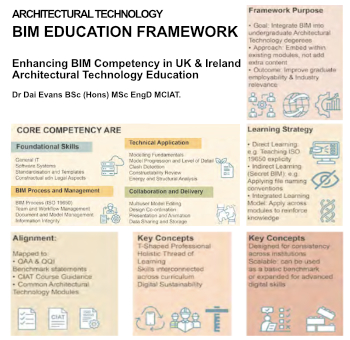

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.